Giải quyết quyền lợi bảo hiểm

Hướng dẫn chi tiết quy trình Yêu cầu Giải quyết Quyền lợi bảo hiểm nhanh chóng, đơn giản

Chi tiết

Thanh toán

phí bảo hiểm

An toàn cho bản thân, an tâm cho gia đình – Thanh toán phí bảo hiểm ngay!

Thanh toán

Thông tin mới nhất

- Tin tức

- Khuyến mại

- PRURewards

- Dịch vụ

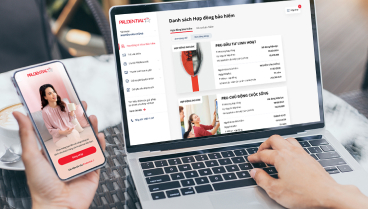

Dễ dàng quản lý

hợp đồng bảo hiểm

Prudential luôn nỗ lực mang đến trải nghiệm quản lý hợp đồng bảo hiểm nhân thọ dễ dàng, tiện lợi nhất cho khách hàng

Prudential đồng hành cùng bạn!

Chọn sản phẩm bảo hiểm nhân thọ phù hợp với nhu cầu của bạn

Kiến thức bảo hiểm

- Bảo hiểm cho con

- Bảo hiểm đầu tư

- Bảo hiểm nhân thọ

- Bảo hiểm sức khỏe

Thông tin các Quỹ đầu tư

Tìm hiểu chi tiết thông tin của các Quỹ đầu tư của Prudential để chủ động thiết lập kế hoạch tài chính và linh hoạt với nhu cầu của khách hàng

Xem chi tiết

Phát triển cộng đồng bền vững

Bên cạnh hoạt động kinh doanh hiệu quả, Prudential đã và đang đầu tư vào các hoạt động xã hội với mục tiêu phát triển cộng đồng bền vững và kiến tạo một cuộc sống khỏe mạnh hơn, thịnh vượng hơn cho người dân Việt Nam, tập trung vào các lĩnh vực Giáo dục, Sống khỏe và An toàn.

Xem chi tiết